Green and Socially Responsible Borrowing: commitment and innovation in the Île-de-France Region

2014

Fonds mondial pour le développement des villes (FMDV)

As resource-diversification tools, socially responsible bond issues strengthen the sustainable development of regions and municipalities. We present here the example of the Île-de-France Region.

Limited budgets, diminishing government subsidies, and banks hesitant to lend: without much room to manoeuvre on tax income, European cities and regions are developing new borrowing strategies on financial markets.

On 19 March 2012, the Île-de- France Region became the first European local authority to issue socially responsible bonds for social or environmental projects targeted before issuance. That innovative financial operation was a genuine success: it raised 350 million euros on the markets, within 30 minutes and at a remarkably low interest rate. It then raised 600 million euros on 15 April 2014, when the initiative was renewed – the most important funding effort ever achieved by a European local government. These operations are part of a three-fold strategy: strengthening financial autonomy, expanding the base of responsible investors and working against tax evasion.

À télécharger : local_innovations_to_finance_cities_and_regions1.pdf (1,5 Mio)

The Île-de-France Region is simultaneously one of the most dynamic poles of wealth-creation in Europe (4.8% of European GDP in 2011) and one of the regions with the greatest inequality in France 1. The challenges related to such inequalities, especially sub-regional ones, are therefore numerous, including the financial engineering needed to address them. For the last fifteen years, the Region has financed part of its investments through bond issues, a trend that has intensified due to decreases in central government subsidies and transfers. It has therefore pursued a policy combining the diversification of funding sources, a responsible commitment to funding environmental and social projects, and a desire for project transparency, with a specific attention to the sources of funding in order to fight tax havens. Green and socially responsible bond issues are a way to promote and anchor these practices. They are an element of Socially Responsible Investing (SRI), which is rapidly growing but still a niche. They hence constitute a pool of resources potentially available to local authorities, which are attractive issuers for concerned investors since they are sustainably rooted in a territory.

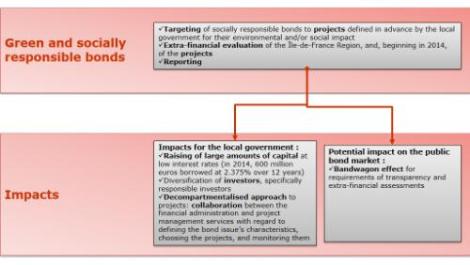

Green and socially responsible bond issuance: how does it work?

Such bonds are unique in that they exist to finance predefined projects with an environmental and/or social impact in the local area. The issuer undertakes to inform investors about the use of the funds and to report on the project progress and their impacts. The innovation thus does not lie in the financial engineering, which is similar to conventional bonds, but in the targeting and allocation of revenues to investments favourable to the environment or the social services of the local authority. These issues encourage the adoption by markets of new practices in accordance with the responsibilities, commitments and needs of local authorities. In 2012 and 2014, the Île-de-France Region relied on private banks throughout the process (defining the bond rates and terms, support on the markets). Thanks to the success of the operation, the Region was able to negotiate very low annual interest rates, over 12 years, for both issues: 3.265% in 2012 and 2.375% in 2014 Repayment is made, as with conventional debt, from the Region’s equity.

When diversification and responsibility go hand in hand with solidarity and transparency

Capital raised by the issuance must correspond to real short-term expenses incurred for projects whose impacts are quantifiable, such as the number of council housing units built or jobs created. Thus, in 2012, even before raising the funds, the targeting of investments to projects selected in consultation with the Region’s operations services had been published officially: 50% to support environmental projects and 50% for solidarity-based economy projects. In 2013, the Region produced an impact report accessible on its website and provided to 23 investors (10% banks, 26% insurance companies, and 64% asset managers – 84% of which are French. By comparison, 75% of the 2014 investors were French and 85% qualified as SRI). In 2014, the Region upped its commitment by having the projects to be funded validated by Vigeo, the extra-financial rating agency, on the basis of 11 criteria grouped into 4 areas: governance, environmental responsibility, social and societal responsibility, and economic responsibility. Finally, since the resolution passed in June 2010 to fight against tax evasion (a source of additional income for local authorities) and to modify practices, the Region used its right of scrutiny during its selection of intermediary banks, requesting that they communicate on their activities country by country. Although inconclusive in the end, provision of that information did constitute a criterion for selecting the managing bank (in addition to the price and quality of the accompaniment offered by the bank).

Factors of success and limits of the approach

The excellent financial (Fitch and Standard & Poor’s) and extra-financial (Vigeo) ratings of the Region and its projects facilitated the success of the issues. With their fifteen years of experience in traditional bonds (socially responsible bonds require no additional financial expertise), the financial and administrative services took them in stride: the 2012 issuance took two months to prepare compared to only one month for the second issuance. Issuing bonds, socially responsible or not, nonetheless remains a tool ill-adapted to small and medium-sized governments (large amounts of capital are needed). These tools therefore remain reserved for big, dynamic local governments with little debt. The creation of Local Government Funding Agencies (LGFA)2 in several European countries should overcome this imbalance by offering medium-sized local governments facilitated access to financial markets via bundled bond issues. It is to be hoped that the LGFAs, which currently finance the budgets of local governments and not specific projects, will develop targeting and transparency systems in order to also contribute to sustainable urban development. Furthermore, if defining new indicators for evaluating the green, social and governance benefits of socially responsible investments remains an issue insufficiently debated by local governments (mainly by banks and NGOs 3), Vigeo’s certification of projects for the 2014 issuance, according to 11 extra-financial criteria, is encouraging. This experience in the Île-de-France Region demonstrates the ability of European local governments to play an avant-garde role in the socially responsible use of financial flows and the regulation of the financial system.

Source: Novethic

from FMDV, 2014

1 The intensity of poverty – the gap between the median standard of living of the poor population and the poverty level – is higher in the Île-de-France Region (20.9% vs. 19% outside of the Paris region). An Île-de-France household of comparable situation to one outside the Paris region runs a 40% higher risk of poverty in living conditions.

In Regards sur la pauvreté en Île-de-France – INSEE (December 2013)

2 See the case study about the Kommuninvest LGFA in Sweden.

3 Such as the Climate Bonds Initiative - www.climatebonds.net/

En savoir plus

Complete case study to be published on the REsolutions website

A study of responsible bond issues produced by Novethic (in French)