A Funding Agency BY and FOR Local Governments: Kommuninvest (Sweden)

2014

Fonds mondial pour le développement des villes (FMDV)

Kommuninvest is the Swedish local government funding agency (LGFA), which was founded in 1986. As of 2013, 90% of Swedish municipalities were members.

An LGFA is an organisation administered by local governments that pool their needs to borrow at a favourable rate. The agency, which borrows on behalf of its members, is an illustration that financial markets are directly and securely accessible for local governments. The Swedish LGFA Kommuninvest was created in 1986 by nine municipalities and a regional council that lacked the technical and structural capacities for access to financial markets. Loans were obtained individually, at high interest rates. This noncompetitive market was the consequence of a series of reforms that had led to the end of state control on borrowing by municipalities and then to a near monopoly by commercial banks. With this as a background, Kommuninvest met an urgent need for an alternative. The agency’s resistance to financial crises was proven twice: in 1993 and 2008. This case study focuses on the political strategies and technical and legal mechanisms associated with the development of an LGFA.

To download : local_innovations_to_finance_cities_and_regions2.pdf (1.5 MiB)

Kommuninvest is a cooperative bank, owned by its member municipalities and open to all Swedish local governments. Each member has one vote, regardless of its size. Membership is granted only to Swedish municipalities and regions that have good creditworthiness. Half-yearly auditing is carried out on its members, which can lead to exclusion by their peers in the event of poor financial management. Membership is subject to payment of dues calculated according to their populations. Thanks to the leverage engendered by this capital, the agency borrows on the domestic and international markets on behalf of its members, at favourable rates. The loans negotiated by Kommuninvest are attractive for the markets because of their significance in value, and thus less costly for the municipalities. The funds raised are then loaned only to the members, in order to finance their budgets. From each loan to the municipalities, Kommuninvest deducts 7 basis points, or 0.07% of the amount, for its operating costs.

(Source : kommuninvest.org)

Cooperation at the heart of operations

The principle of Kommuninvest is thus to pool the needs of municipalities, so as to negotiate on behalf of all of the latter to obtain the best loan possible. This leads to in-depth cooperation among the municipalities. Each member municipality bears individual responsibility for Kommuninvest within a joint guarantee system. If the LGFA faces difficulties, each member must pay back what it borrowed. This encourages the municipalities to maintain strict budgetary rules, because they act as a guarantor of last resort instead of the central government. This leads to a win-win situation: the municipalities reduce their financing costs, and the central government is relieved of the municipalities’ financial responsibility for the agency’s actions. Furthermore, Kommuninvest has established strict rules to reduce risks, thanks to a diversification policy: each investor represents only 3% maximum of the total amount of loans, and the 10 major borrowers in reality represent only 23% of this same amount1. Also within the framework of risk minimization, the agency undertakes not to contract toxic loans by proposing only non-derivative loans. Kommuninvest is run via participative governance: the voting members at the cooperative’s annual general meeting are elected officials from the municipalities, each of which has one vote. At the operational level, the financial transactions are managed by Kommuninvest i Sverige AB, the subsidiary of the cooperative. Its board is composed of professionals. The Kommuninvest Cooperative Society is also the sole owner of the LGFA, thus ensuring that activities are in the general interest of its members.

Results and impacts

Financially, Kommuninvest makes it possible for municipalities to:

-

be responsible for their solvability (default on payment by a municipality would endanger the very existence of the agency);

-

diversify their financial resources;

-

pool and thereby reduce operation costs;

-

build capacities. Institutionally,

the LGFA helps to:

-

strengthen the reflex of municipalities to cooperate, including on such crucial information as the state of their finances;

-

shake up the existing systems and replace them with more participative and egalitarian governance, through its cooperative status.

Administratively, the agency has been a driving force for the financial capacity building of municipalities, by:

-

¡imposing new standards of management;

-

¡organising the transfer of its expertise to municipalities via training courses and technical seminars.

Administrative and political limits that are often unfounded

The agencies provide a viable alternative for the diversification and securing of financial resources, but there may be some reluctance when they are created, often due to poor understanding of their principles and of how they work. The main challenges are to reassure banks and investors about the stability of the LGFA, to encourage financial cooperation among municipalities and to overcome the bureaucratic obstacles of pre-existing public administrations. The LGFAs must thus give priority to raising the awareness of local decision-makers on the benefits related to cooperation. For an LGFA to exist, it is also necessary for the central government (often the finance minister) to grant local governments the required leeway for independent access to the loan. The central government may feel this empowerment of local governments as a loss of their control over local finances, and this can act as an impediment to the establishment of the agency.

A proven and replicable system

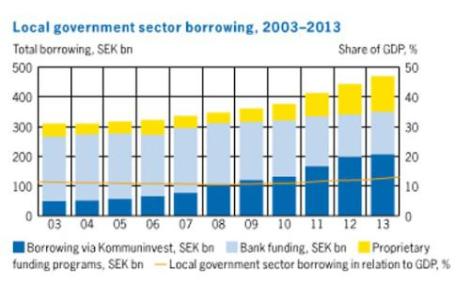

Kommuninvest is currently the market leader in Sweden for loans to municipalities. In 2013, these loans came to 208 billion Swedish kronor (23.5 billion eurosx2). Proof of its acceptance by more traditional financial players can be seen by the triple A status granted to it by the credit rating agencies Moody’s and Standard & Poor’s, which note its sound finances in a growing market as well as the good management of its funds. This long-term system of cooperation among municipalities has thus proven its worth for more than 30 years in Sweden. In Denmark, a similar system has been in operation for more than 110 years. Such agencies also exist in the United States, Canada, Italy and the Netherlands. The New Zealand Local Government Funding Agency and the Agence France Locale were created in the last two years, and others are in development in the United Kingdom or under discussion in many countries. We can thus see that the LGFA model is effective for all types of local governments in different national contexts.

From FMDV, 2014

1 Kommuninvest annual report (2013)

2 Kommuninvest of Sweden (Mars 2014) The Swedish Municipal Sector’s Internal Bank

To go further

The in-depth case study is available on the REsolution website, in relation with a leaflet on LGFAs available on the FMDV website.

The Kommuninvest Annual Report 2013 is available on its website

Further publications on LGFAs have been produced by the institution Mårten Andersson Productions and are available on its website

Finally, the Danish and French LGFAs explain their approach at kommunekredit.com